Activate VAT support

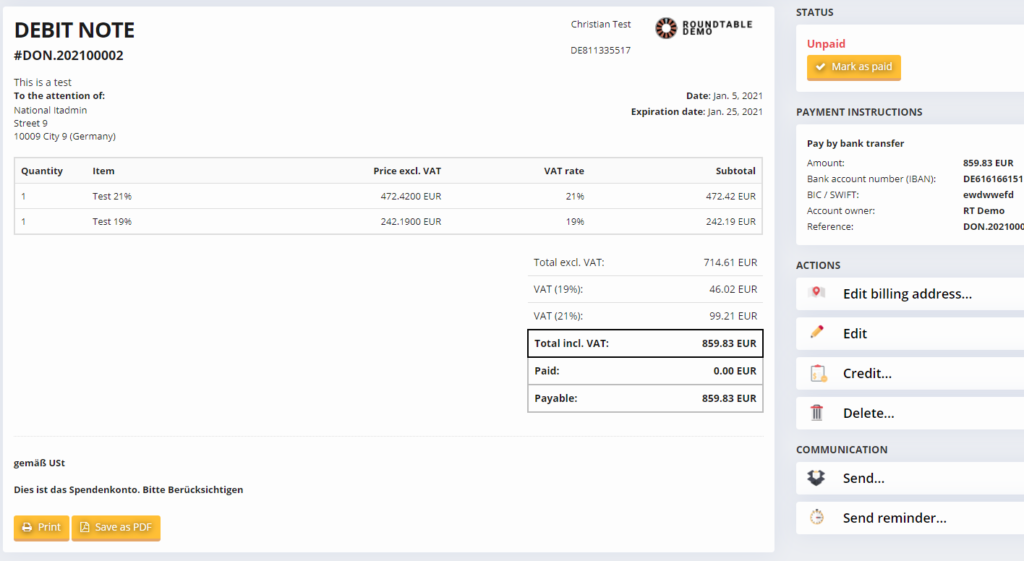

The support for VAT can be activated when adding new or editing unused financial organizations (Admin – settings – finances – preferences). After activation, this cannot be deactivated. A valid VAT number is required for the activation of VAT, this is checked in the VIES database .

You can have financial organizations without VAT (e.g. membership fees) and with VAT (e.g. sponsoring).

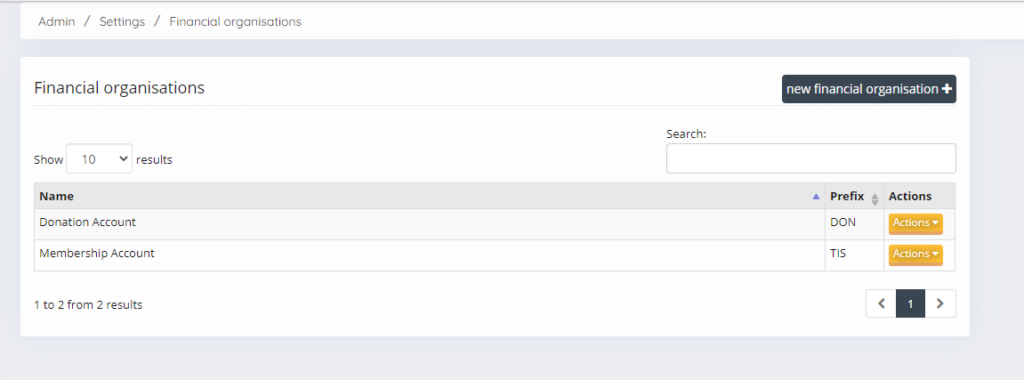

Invoices with VAT

Within a financial organization with support for VAT, invoices will always show amounts excl. And incl. VAT . Tables and exports will also contain additional data.

On the invoice itself you will also find a breakdown of all used VAT rates with the correct amounts:

Manage VAT rates

Before you prepare an invoice, you need to set the VAT rates in the general settings.

See here how to do that

Set the VAT rate

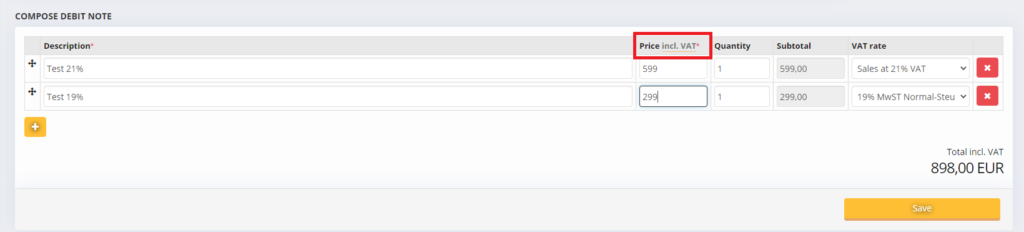

When preparing an invoice

When drawing up an invoice, you must select a VAT rate per invoice line. The Tabler.World will automatically calculate the total amount.

You can switch between exclusive and inclusive VAT by clicking on the link next to price (indicated in red):

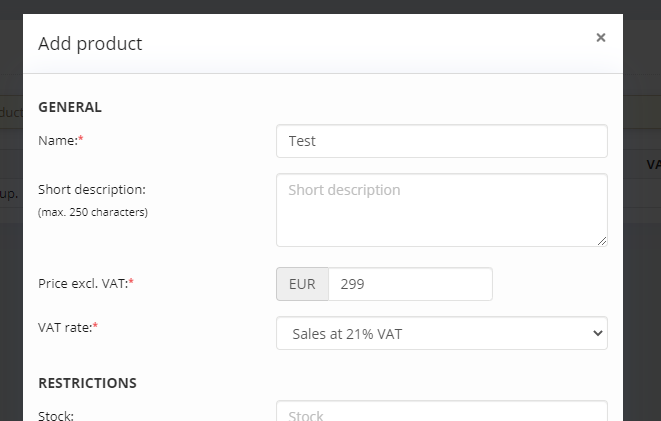

When creating an activity

Depending on the type of activity you add, you will be able to set a VAT rate at either activity level (closed activity) or product level (open activity, sales).

These rates are automatically taken into account when paying for the activity.

When creating a cost

You can also choose the VAT rate when creating a cost.

This post is also available in:  Deutsch (German)

Deutsch (German) Nederlands (Dutch)

Nederlands (Dutch) Français (French)

Français (French) Svenska (Swedish)

Svenska (Swedish)